Getting Started with Avalara AvaTax: Why Your Online Business Needs Sales Tax Automation

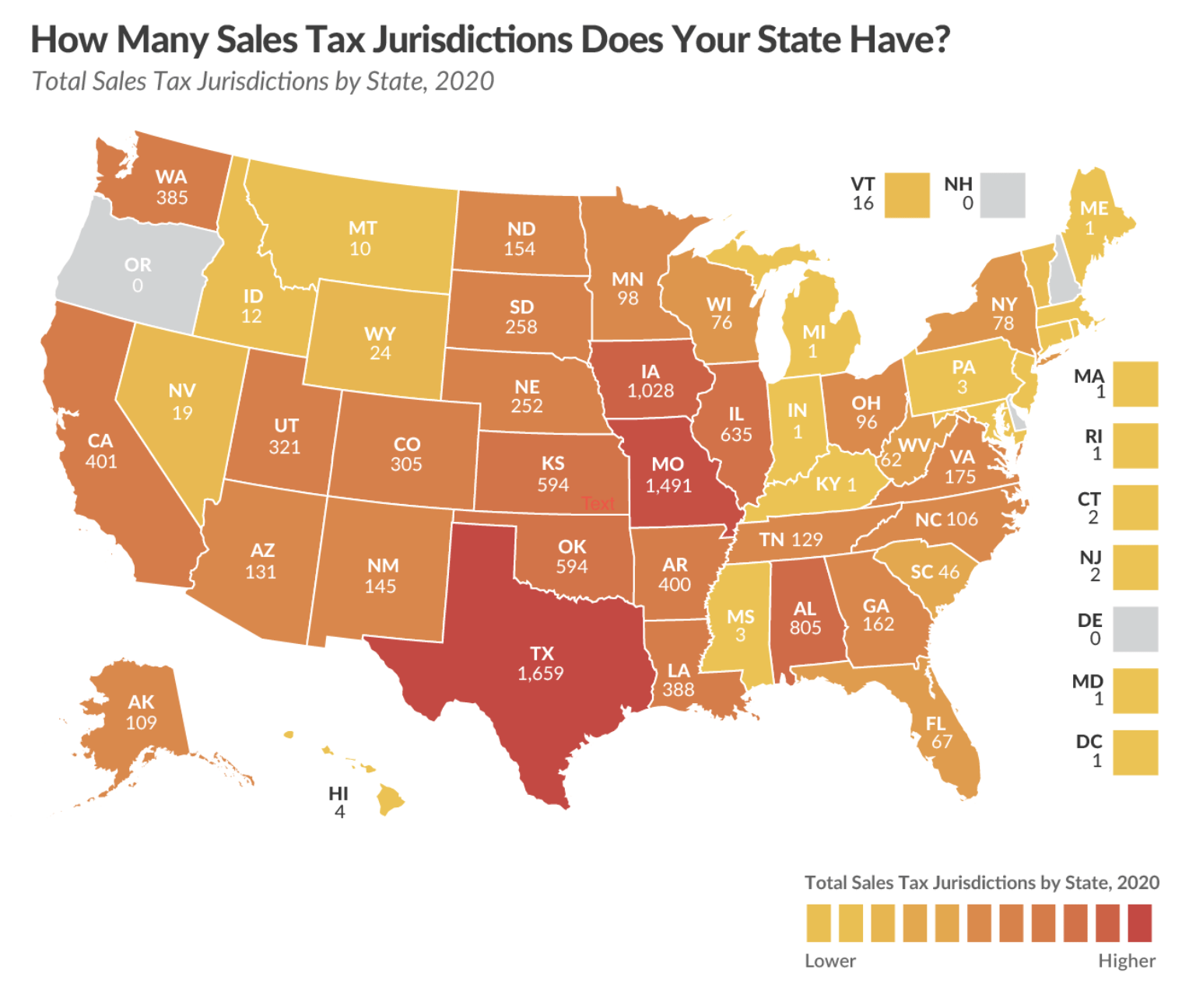

While running an eCommerce business, regardless of your domicile status, you face multifaceted challenges that the US tax system imposes. A patchwork of 50 states with different tax rates based on the state sales tax laws complicates the task of staying tax-compliant.

An eye-opener: There are about 11,000 different authorities that impose a sales tax in the United States.

Source: Tax Foundation

As more and more sellers were gaining online presence, tax jurisdictions reconsidered their requirements for online entrepreneurs. Adding some new sales tax laws, such as the tax nexus Wayfair ruling, made tax categorization more complex. And with that, try to picture how dealing with VAT rules can make things even worse when it comes to selling internationally.

With their heads twice the size, online entrepreneurs generally get swamped by a screed of sheet reports and tedious sales tax calculations. And this is where sales tax automation software makes the case. The trickiest thing is to choose the one that can:

- be easily integrated with your shopping cart solution

- be affordable and user-friendly

- help you resolve common sales tax burdens, like address validation and tax calculations for a wide variety of SKUs

- provide well-versed and up-to-date tax advice and sales tax compliance services

- automate time-consuming tasks and save you from the monotony of filling out tax information by hand

- minimize the risk of tax reporting errors which can ruin customer trust and trigger even more severe tax compliance problems

In this post, we take a deep dive into the functionality of the Avalara AvaTax sales tax solution and run through its main features to know whether they meet your eCommerce business requirements.

First Thing’s First: What Is Avalara?

As avid enthusiasts of the tax industry, the Avalara team has designed tax compliance software for small, mid-sized businesses, and enterprises to take the burden of tax management off the online sellers’ shoulders.

To expand your tax expertise, Avalara offers a vast library of educational resources shedding some daylight on the main taxation trends: blog posts, webinars, seminars, and digital events hosted by the industry leaders. Diverse and well-structured information resources make it easier to uncover valuable tips on obtaining tax compliance for energy producers or finding an update on VAT rates.

Main Features and Products

All in all, Avalara distinguishes itself with five types of products meant to assist you with all the facets of digital taxation.

- Avalara Sales Tax Calculator helps online sellers calculate sales tax rates based on the tax nexus.

- Avalara Returns Solutions branch into three types: Returns for small businesses, Managed Returns, and Managed Returns Premium, all allowing for a quicker and easier tax filing, regardless of your tax type (including VAT returns, lodging tax returns, or returns for energy producers distributors traders, and retailers, to name a few).

- Avalara Exemptions Certificate Management System simplifies and automates collecting and storing customers’ certificates and dealing with exemptions.

- With Avalara Licensing Solutions, you can manage your licenses through a single and secure database. At the same time, you can gain support while applying for tax licenses, permits, or tax registrations.

- Avalara Content and Data Automated Solutions are designed for tax research and compliance analysis.

Avalara Integrations

Along with full-fledged eCommerce platforms, like X-Cart, Avalara sales tax software connects ERP and CMS systems, payment processors for accounting professionals with partnerships, and automated solutions for tax research.

In addition, Avalara partners with the most popular software applications for eCommerce business, allowing you to sell on eBay, Amazon, and Walmart, using payment systems like Stripe, Square, PayPal, and many more.

What Is Avalara AvaTax?

Among the wide range of tax-related services that Avalara offers, AvaTax is a flagship software product that helps online sellers keep up with sales and use tax requirements, generates reports on tax returns, and handles exemptions.

A cloud-based solution, AvaTax is user-friendly and, like most no-code tools, doesn’t require coding skills to apply or configure. At the same time, it is easily integrable with third-party services and eCommerce platforms, providing a host of integrations and offering an advanced API, just if you didn’t find the integration that best fits your business needs.

Important note: Avalara’s AvaTax Sales Tax Automation add-on by X-Cart is designed to manage tedious sales tax calculations and returns filing to meet complex tax compliance requirements in the United States and internationally.

Can Avalara AvaTax Ease My Sales Tax Headaches?

Short answer is yes!

Here are at least four clear benefits for you if your eCommerce platform is integrated with the Avalara AvaTax plugin.

1. Streamline Your Tax Calculations and Returns

Avalara tax automation software calculates tax rates, validates the customer’s address information, and automatically inputs the results into your shopping cart or invoice at the time of purchase.

Integrated with your eCommerce platform, AvaTax also manages the heavy lifting of the filing procedure, thereby saving you the pains of filling out the immense amount of information by hand.

2. Stay Tax Compliant

With all the shiftiness and multiformity of the US economic nexus laws, even a seasoned online seller doesn’t feel entirely at ease with tax determination and reporting. As a result, some eCommerce businesses find themselves unintentionally non-compliant, which may lead to severe tax audit penalties.

Luckily, there is a way to avoid tax sanctions and keep tax compliance under control by utilizing an automated AvaTax sales tax tool.

Check the Avalara Economic Nexus Guide to understand state-by-state tax compliance requirements.

3. Improve Taxing Accuracy

While inaccurate sales tax calculations impose serious risk for your business credibility, AvaTax service provides highly accurate product taxability assessments. It significantly reduces the possibility of human error, thereby delivering a better customer experience and contributing to the number of positive reviews.

On top of that, AvaTax generates detailed real-time reports on-demand and allows the export of data for transactional tax filing.

4. Benefit from Streamlined Sales Tax Program

Because of the currently implemented tax nexus laws, enrolling in a Streamlined Sales Tax program has become critical for eCommerce businesses with economic tax nexus in multiple states. Let’s first figure out what an SST Program is if you are still unaware for whatever reason.

A shortcut:

Streamlined Sales Tax (SST) is a program designed to make sales tax compliance easier and more affordable.

How does it work?

The US states which participate in the SST program offer simplified tax registration requirements and more uniform rules for calculating taxes and filing returns. On top of that, they offset the cost of your automated sales tax solution provided that you are using a certified service provider (CSP), like Avalara.

Current SST states:

Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, Wyoming

The Avalara sales tax automation solution in combo with SST registration can give you the benefit of simplified sales tax requirements without eating out your budget.

FAQs

Yes. Moreover, you may extend your trial after the initial trial period expires. To extend your trial, log in to AvaTax following trial expiration, and select Need more time on our free trial? This extension will only be available one time. For X-Cart customers, Avalara offers a 60-day free trial.

Avalara has more than 700 pre-built integrations, or connectors, across ERP, billing, point of sale, and eCommerce platforms, including X-Cart. You can find more details about available plugins on the Integrations page on Avalara.com

Avalara’s sales tax calculator returns sales tax rates based on geolocation, which is more accurate than rates based on ZIP codes, states or counties alone.

You can use AvaTax codes for goods and services to determine the taxability of the goods and services you sell.

Yes. With Avalara AvaTax, sellers can calculate the correct VAT for each transaction and create tax tables for VAT and customs duties in their eCommerce solutions.

Yes. Avalara offers sellers a cross-border solution to assign tariff codes, apply VAT and GST rates, and file and remit international taxes.

Final Thoughts

If you are a newly-fledged owner of a small business, you may not need a solution automating time-consuming tax management right off the bat. However, as your online business grows and expands, affecting your customer base and transaction volume, tax rate calculations grow more complicated. This is the right time for an online seller to implement an automated solution for tax research and calculation.

Using tax automation software can be a no-brainer with a scalable and configurable eCommerce platform. By offering a host of integrations including Avalara, the X-Cart Shopping Cart solution addresses this challenge. Assign taxes to all your product variations, validate customer addresses, and manage sales tax returns properly with X-Cart and Avalara working as a killer combo.

Simplify Tax Management

Install AvaTax Sales Tax Automation Add-onor

Contact X-Cart for a Different Custom Tax Automation Solution

Maria is a marketing manager at X-Cart. Once captured by digital and content marketing in her student days, she keeps living and breathing it ever since.