[Automotive Industry Timeline] Why Now Is the Right Time To Tap Into the Automotive Industry

It’s hard to believe that the automotive industry, being one of the most important economic sectors in the world, started moving online a decade later compared to other retail industries, according to a study by Bain & Company.

However, even with shoppers handcuffed to their homes by the COVID-19 pandemic, online auto sales have spiked to unprecedented levels, signaling the disruption of Auto & Parts eCommerce.

The automotive industry is changing rapidly, particularly with what just happened with COVID. Stores were shut down for a long time and had to get very, very creative in how to engage their customers, and how to continue to buy cars despite not being able to see them face to face.

As of now, the situation in the automotive industry looks like this:

- It requires somewhere from two to five visits to the dealership to complete the transaction (which is a lot!), and this is the reason why shoppers are gravitating towards more intensive use of the Internet.

- Car dealers acknowledged the tendency and took the first steps into the online world as well. The most aggressive automotive trendsetters such as Tesla are pushing the envelope by planning to close ALL their retail stores and start selling their products online.

- As a result of all those changes, the car parts industry revenue is projected to grow to almost $8.931 trillion by 2030, up from 5.3 trillion in 2017.

Download this Automotive Industry report for a more relaxed offline reading.

Online car buying platforms such as Roadster, Carvana, TrueCar, CarMax, and AutoZone reap the benefits of people staying home and gradually changing the industry.

- Carvana’s revenue in March 2021 was 2.245 billion dollars, a 100.46% increase year-over-year (Source).

- Roadster’s estimated annual revenue is projected to be $62M per year (Source).

- TrueCar has a yearly revenue of $0.265M (Source).

- CarMax’s revenue is $18.95B which is 70% more than what Carvana does yearly (Source).

- AutoZone has $2.911B in sales, a 15.8% increase year-over-year (Source).

How do X-Cart stores differ from those more general automotive retailers like AutoZone or Carvana?

I think from the user perspective the smaller, more nimble companies are more personal. Their offerings are more specific. For example, I can order generic window coverings for my Mercedes Sprinter 2500 from AutoZone for $20, or I can go to an Etsy-like shop where a guy is like: “I’m all about Mercedes Sprinters. I’ve been dealing with them for 20 years. I have 20 different models, and I can even do custom window coverings. If you want windshield driver and passenger, or if you want the whole frickin van, I can do the moon-shaped ones, the circle ones, the rectangular ones, and the square ones, and they’re all magnetic, and they work really well. And I’ll pay a premium for that.

I. How did we get here?

Here’s a brief timeline of how the automotive industry evolved over time.

The 1880s: The birth of the first automobile

1886 — the first ‘horseless carriage,’ called The Motorwagen, was registered by Karl Benz in Germany. This date is officially considered to be the birth of the automobile industry.

The 1890s: Benz — the world’s car market leader

1899 — 572 vehicles were manufactured.

1903 — 30,124 cars were manufactured in France only (63% more than the US did).

The 1890s – 1945s: Getting US on the map

The Days of Henry Ford

During the days of Henry Ford’s production line, the auto industry was based on the “supply-push” philosophy. In other words, volume: manufacturing a great number of various car brands and pushing them to the audience through rigorous marketing tactics.

The turbulent market economy, which was another defining feature of Ford’s time, pushed conventional dealers to hike prices and reduce services offered to the customers.

How Dealer Networks Began

The ‘supply-push’ model has grown into dealer networks, which were created to hold inventory, leverage private capital, and offer service & support for less reliable and more maintenance-intensive products.

Dealer networks were based around entrepreneurs focused on a limited geographic area, selling no more than a couple of car brands. Aggressive pricing tactics that were so popular at that time were based on customers’ willingness to pay.

Dealers were competing not against another brand but against a same-make dealer across town.

The 1940s: World War II: Cars sales stalled

The car sales were reduced dramatically until the end of military operations. With people coming back to normal life, automotive production started to ramp up again, referred to as the “Car Boom.”

The 1950s: Total pricing anarchy

Strangely enough, the increased demand for accessible vehicles led to pricing chaos. To protect consumers from pricing discrepancy, Senator Almer Monroney introduced a new rule requiring car dealerships to place a sticker with a recommended retail price and a list of specs on each vehicle sold.

The 1970s: The advent of car leasing

In the 50s and 60s, the automotive market flourished. However, by 1973, car production costs rocketed due to the increasing price of gasoline. As a result, car manufacturers slashed the number of models on the production line. As the cost of manufacturing increased, car prices went up as well.

The 1980s: The birth of the used-car market

With the rise of car prices, leasing and auto parts sales became more and more popular.

- As of now, the used vehicle industry represents almost 50% of the US auto market.

- The US online sales of auto parts and accessories is also growing at a rapid pace. It’s projected to reach 21.4 billion by 2023 with most of those sales happening on smartphones.

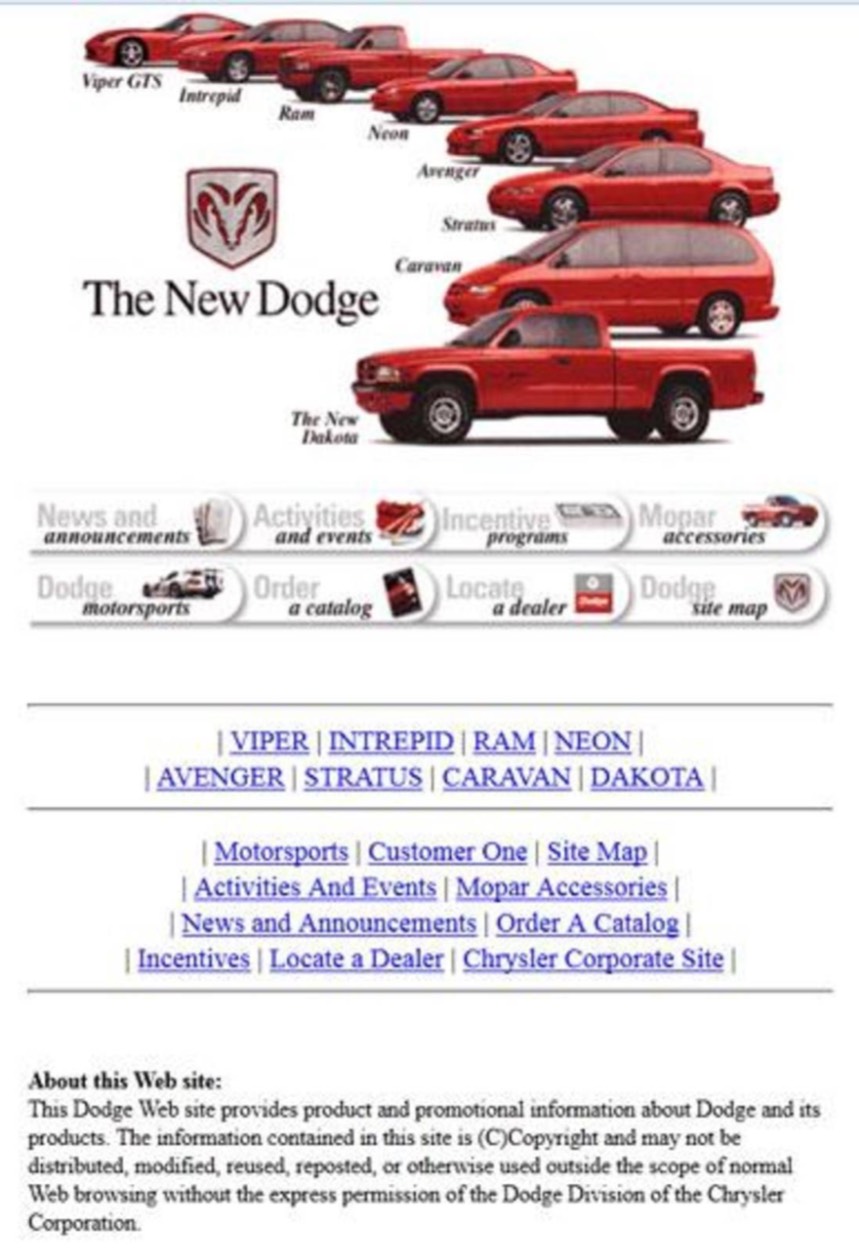

The 1990s: The very first steps to the online world of car shopping

With the increased number of car brands and models, selecting the right vehicle became a much more complex decision. This is how car dealers started exploring virtual options to connect with potential buyers. However, the dealership websites acted only as online brochures with no option to purchase a vehicle online.

2008: Financial crisis

Worldwide automobile production dropped by 12.4%. Five years after the crisis, car sales started to bounce back, which resulted in 89 million cars sold all over the globe.

2021 – …: The Post-COVID Era

The post-pandemic period that we are living in is truly the era of innovation.

Due to the overall instability in the world and border closures, car prices have been driven higher: Used-car prices soared 29.7%, and the cost of rental cars has increased by more than twice, according to NPR. At the same time, a year of self-isolation is sparking a surge in spending, and those who have a few strings to their bow are willing to pay up.

So what does the future hold for the automotive industry? The shift towards digitalization and omnichannel experience is inevitable. However, the human element and a high level of personalization will remain an integral part of the auto buyer’s journey.

II. What has changed?

According to the Beepi Consumer Automotive Index, people are completely dissatisfied with the old-school experience dealerships have to offer. Lack of transparency regarding pricing, long wait times signing all the documents and insurance, and sleazy salespeople turn shoppers away from in-person shopping. As a result, a staggering 87% of American adults dislike the process of purchasing a vehicle at a traditional car dealership.

Another survey reported that 61% of car shoppers’ time was already spent in front of a computer.

Emerging services & trends brought to the car industry by the pandemic

Below are the new services & trends that come to rescue modern shoppers from the need to visit dealerships and, hopefully, improve overall experience:

- Purchases without leaving homes, including Finance & Insurance and eContracting instead of five hours in a dealership.

- Virtual walk-arounds for car shoppers using live video and VR 3D virtual tours.

- Test-drives at home instead of driving to dealerships to get the service.

- Local new vehicle delivery instead of pick up and drop off at a service department.

- Clear, transparent pricing without useless, burdensome negotiations & haggling back and forth.

- Leasing to fully outpace car ownership.

- Omni-channel experience will be critical.

Challenges merchants have to overcome selling cars & car parts online in 2021

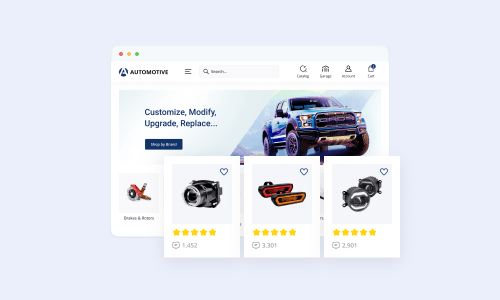

The automotive world goes way beyond what a simple eCommerce platform has to offer. It’s about the experience. It’s about community. It’s about making sure that you find exactly what you need. It’s speed, comfort, and configurability. An eCommerce seller has to make sure that the whole experience and the sense of community live up to the buyer’s expectation because these are going to make them fans in the future.

III. What’s next?

The biggest challenge is finding the right eCommerce platform to power the Auto and Parts sales online:

- Cost-effective solutions: You don’t want to pay exorbitant fees to build it all from scratch yourself; that just doesn’t make any sense. Also, a simple out-of-the-box Buy button-like shopping cart won’t work if you want to stay competitive in the changing automotive industry.

- Think ahead: The platform should go in line with the style of business you have — it should answer all your requirements and be flexible enough to change as your business grows.

- In an ever-changing world, choose a platform that changes with you: You should be able to add more features on the go, as your business is not something static, it should evolve with time, and your shopping platform should have enough options as well.

- Unique user experience: As other options surely come into play, such as speed, especially if you have many SKUs and images, the quality of product images, and security — your automotive store should be designed with the latest design and digital technology trends and be stable no matter how much traffic comes to your site, especially during Black Friday/Cyber Monday sales.

- Speed matters! Robust search and filtering are a must.

When you can get something like Cloud Search, for example, that has intuitive search capabilities to get people to very quickly exactly what they’re looking for is a tremendous hurdle to get over.

Need Help Selling Cars or Automotive Parts Online?

The X-Cart team is at your service. We are here to help you bring any idea you have in mind into a solid online store that grows with your business.

Header text

Want to See Your Store in Action?

We’ll connect you with a eCommerce expert who can show you the unique features that X-Cart can add to your online automotive store.

Helen is an SEO and Content Marketing Specialist. She has been creating and planning content for over 10 years, with 5+ years specializing in eCommerce.